Highlights

- The CTC creates work incentives especially for families with more kids. Post This

- Just like the EITC, the CTC explicitly rewards lower-income families for making efforts to enter the workforce. Post This

- The ultimate way to maximize the work-promoting incentives in the CTC is, simply, to make it bigger. Post This

Congress is debating an increase to the Child Tax Credit (CTC)—an increase which, if large enough, could meaningfully increase American birth rates. But many people may view a bigger CTC with some trepidation: will throwing more money at births just lead to more children on welfare? Could benefits like this even be dysgenic?

In the case of the CTC, the answer is no—a bigger Child Tax Credit will increase the incentive for parents to work. The classic conservative critique of welfare supports creating dependent families simply doesn’t apply to the CTC, which phases in specifically as a reward for work. Here, we’ll briefly show (1) how the CTC rewards work, (2) how modest reforms of the kinds Congress is considering could encourage work even more and, (3) how IFS’ proposal for a much bigger CTC massively expands work incentives and could increase fertility and employment.

How the CTC Encourages Work

As the law is currently written, the Child Tax Credit has what’s called a “phase-in.” This means, very low-income people cannot claim the full value of the credit. For every $100 in household earnings beyond $2,500, families can claim an additional $15 in credits. That means that, while it’s phasing in, the CTC basically operates as a “negative tax rate,” specifically, a negative 15% tax rate. Since the base tax rate at lower incomes is 10% or 12%, depending on exact income and filing status, the CTC phase-in basically gives families a slightly negative overall tax rate (not accounting for other credits like the EITC, or the role of various deductions).

In other words, the way the CTC works now, the government is actually paying parents to work. Just like the Earned Income Tax Credit, the CTC is one of several programs that explicitly reward lower-income families for making efforts to enter the workforce and hold down a decent job.

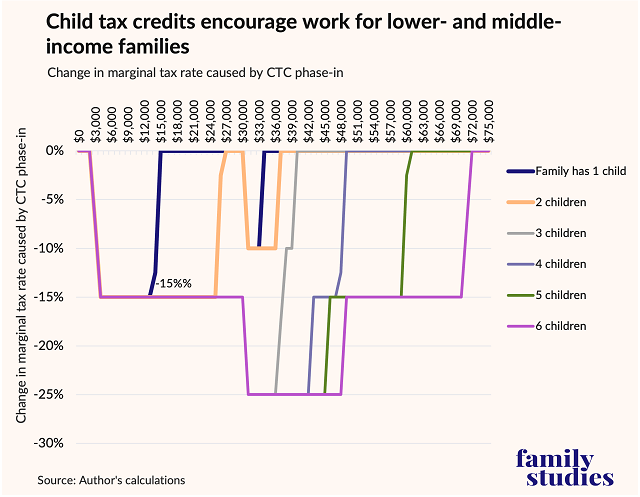

The figure below shows the work incentives created by the CTC for households with different incomes and numbers of children. It shows, for example, that families with any number of children have a -15% tax rate effect from the CTC at around $8,000 in income—that -15% effect vanishes as income rises based on when credits are fully “phased in,” and interaction with the “nonrefundable” element of the credit.

Negative tax rates can exceed -15% because the CTC has both a refundable and nonrefundable component, and their interactions with background tax rates and deductions can be complicated. So, for example, families with 3 or more children and $33,000 in income would have a -25% tax rate effect from the CTC. Regardless, the basic point is: for families with 1 child, the CTC produces work incentives for anybody under $15,000 in income; for those with 2 children, it produces work incentives for those under $36,000 in income; for those with 3 children, it produces work incentives for those under $39,000 in income; for those with 4 children, it produces work incentives for those under $48,000 in income, and so on. The more kids a family has, the more income they have to earn to claim the full credit value, which means that the CTC creates work incentives especially for families with more kids. This means the CTC doesn’t run the risk of creating “welfare queens:” families with lots of kids and low earnings simply cannot claim the full value of the CTC, so there’s no risk of dependence at all.

How the CTC Could Encourage More Work

Now, there is one significant wrinkle in this description: the phase-in begins at $2,500 in earnings. In other words, families get no reward at all for the first $2,500 in earnings they make. Thus, the CTC creates incentives for families with some work to get more work, but it doesn’t produce as much of an incentive for families with no work to get some work.

One simple way Congress could fix that problem is to eliminate the $2,500 floor for the income phase-in. The CTC already rewards work through its phase-in—but not for people considering where to start working. By removing the $2,500 income floor for the phase-in, the CTC can be made to provide a stronger encouragement for non-working parents to enter the workforce, even if their job doesn’t immediately provide a lot of earnings. This change would not add a huge cost to the CTC and would increase the work incentives it creates, so is worth Congress considering.

The other major way Congress could increase work incentives would be to increase the phase-in rate, such as by allowing the nonrefundable credit component to be claimed against Social Security taxes, or increasing the refundable credit phase-in rate from 15% to 20 percent. But these approaches run into a problem: they provide greater work incentives for lower-income people by shifting work incentives down the income ladder from where they initially were.

How to Maximize the CTC’s Work-Promotion

The ultimate way to maximize the work-promoting incentives in the CTC is, simply, to make it bigger. When the total credit value is increased, this makes it possible to increase the phase-in rate without removing work incentives higher up the income scale. As strange as it may sound, it’s true that making the Child Tax Credit bigger actually increases work incentives! Because many people think of the CTC as help for families, they often imagine it as welfare that discourages work—but because the CTC phases in with income, it rewards work, which means making the CTC bigger increases the total reward for working.

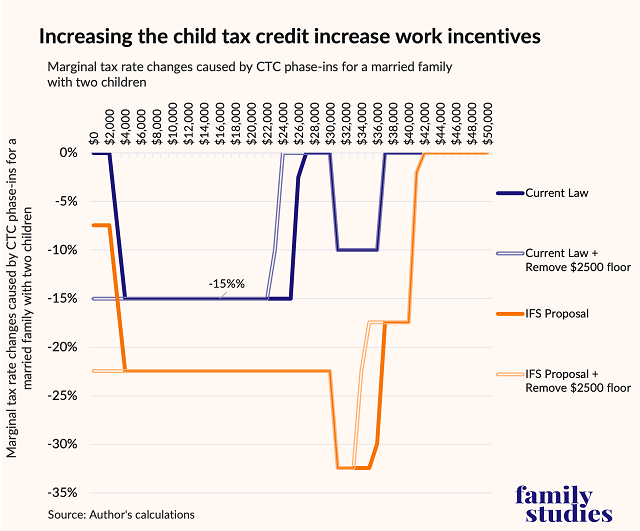

We’ve written up some ideas about how we think the CTC could be improved, most notably, by increasing its total generosity to $4,500 per child and allowing the nonrefundable credit to be claimed against Social Security taxes. The figure below shows the tax rates created by the CTC 1) under current law, 2) under current law if the $2500 floor were removed, 3) under our recent proposal, and 4) that proposal again if the $2500 floor were removed.

The blue lines show current law, and the effect of removing the $2500 floor for the CTC phase-in. Removing the floor creates new work incentives for people under $2500 in income (i.e. incentives for nonworkers to pursue employment), but it reduces work incentives for workers with incomes around $25,000.

But increasing the CTC and allowing the nonrefundable credit to be claimed against social security taxes, as we have proposed, creates bigger work incentives at every income range! For a family with two kids and about $33,000 in income, their child tax credits would create a negative 32% tax rate, as their refundable CTC portion would still be phasing in at the 15% rate, while their nonrefundable portion would be claimable against both their 12% income tax rate and their payroll taxes. Removing the $2500 floor for the refundable credit boosts work incentives at low income and removes some of the extremely large work incentives over $30,000 in income.

Thus, Congress could consider incentivizing parents to enter the workforce by removing the $2500 income floor for the CTC—but Congress could also consider simply expanding the CTC in general, as we have suggested. A bigger CTC means parents face much stronger incentives to work, which means more parents will earn their way out of welfare dependency, reducing spending elsewhere, and contributing to overall economic growth.

Lyman Stone is Senior Fellow and Director of the Pronatalism Initiative at the Institute for Family Studies.

*Photo credit: Shutterstock