Highlights

- Republicans prioritize day care for two-earner families over boosting the child tax credit for all families. Post This

- The average income of families utilizing paid child care in the U.S. is nearly $180,000. Post This

- Not only did the Republican Senate not take the opportunity to match the House’s generosity regarding the CTC, they also boosted three different policies that only serve families who rely on paid child care outside the home. Post This

Mitt Romney and J.D. Vance had their differences when they served as senators together in the last Congress. But they shared a common commitment to family policies that served all families with young children—including those who relied on a family member to care for an infant or toddler at home—rather than just those families with both parents in the workforce and their kids in paid child care.

Romney pushed for an expanded Child Tax Credit (CTC) that would have been worth $4,200 for all working families with children under age 6. Vance called for a $5,000 child tax credit in last year’s presidential campaign. And both Vance and Romney made it clear that any new family policy spending should not favor families who rely on paid child care outside of the home but rather should be aimed at all families, including those who choose to care for their young children at home.

In opposing a 2021 Biden plan to spend billions of new dollars on paid child care, for instance, Romney noted that his CTC plan would “instead provide that funding … to families and let families make the decision as to how they want to care for their children,” adding, “It’s giving the parent the financial resources to make their decision where they want their child to be cared for”—inside or outside the home.

More money, more choices for all working families with young children. Sounds like a good family policy approach in a day and age when fertility has hit record lows and people routinely mention the costs of raising kids as one reason they are not having the children they would otherwise like to have.

Unfortunately, this kind of pro-family thinking was notably absent when Senate Republicans took up the “One Big Beautiful Bill” (OBBB) earlier this year. The Senate Finance Committee, chaired by Sen. Mike Crapo (R-ID), took the House version of the CTC that serves all working families, which the House had set at $2,500 per child, and downsized it to $2,200. This meant that the Senate version of the CTC did not even keep its value from Trump’s first term after adjusting for inflation.

So much for serving the majority of the parents who voted Republican in 2024.

Not only did the Republican Senate not take the opportunity to match the House’s generosity regarding the child tax credit, they also inexplicably boosted three different policies that only serve families who rely on paid child care outside the home. Republicans in the Senate almost doubled the Child and Dependent Care Tax Credit, from $1,200 to $2,100, which reimburses parents for certain child care costs, and they also expanded flexible spending accounts (DCAP) and business tax credits (45F) for child care.

USA Today called this $16 billion carveout for child care in the OBBB the “biggest increases to child care tax programs in a generation.”

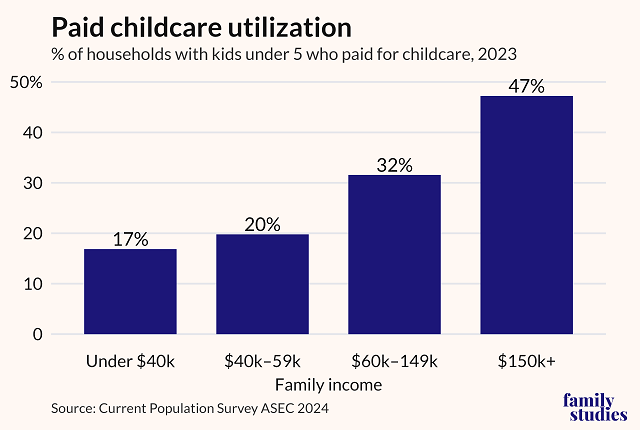

The Republican leader in the Senate for this child care push was Senator Katie Britt (R-AL), who buttonholed every single member of the Senate Finance Committee. Unfortunately, her efforts will end up disproportionately benefiting a privileged minority of families: the majority of American families with children don’t currently use paid child care, and those who do are disproportionately among the wealthiest. In addition, the way the CDCTC is set up means it completely excludes married couples where one spouse is a stay-at-home parent.

In fact, just 27% of kids ages 5 and under are enrolled in paid child care, according to the 2024 Current Population Survey’s Annual Social and Economic Supplement (CPS ASEC). These kids disproportionately come from middle- or upper-class families, with highly educated parents, and are living in some of the most educated and advantaged areas of the country—places like Cambridge, Massachusetts; Ann Arbor, Michigan; and Washington, D.C. The average income of families utilizing paid child care in the U.S. is nearly $180,000.

Where is the pro-family agenda that the rest of the country was promised?

This was an unforced error on the part of Senate Republicans. Rather than catering to the most privileged parents who choose to work outside the home, allowing all parents to keep more of their own money each time they grow their family would benefit all families. And it would have sent a much better message.

Instead, Senate Republicans sent the wrong message: that our government is more committed to incentivizing high-income parents with post-graduate degrees than it is willing to empower working parents who desire to stay home but can’t. Perhaps it wasn’t their intention, but the Republicans who spent their political capital on these narrow child care tax credits have unwittingly reaffirmed the unhealthy view that caring for your own children really is an impediment to the most important part of American life: pursuing a high-flying career in a place like Cambridge, Massachusetts, or Washington, D.C.

Certainly, there are families in which both parents must work due to financial necessity. But survey results suggest that elite parents and ordinary parents have very different goals: well-educated high-income parents say their highest family policy priorities are work-related (paid family leave or subsidized child care) while parents without a college degree say their highest policy goals are something like an expanded CTC or a wage subsidy. The working-class view also aligns with the way social conservatives think about this issue.

Two pillars of the Republican coalition, social conservatives and working-class families, agree that simply allowing parents to keep more of their own money is a much more “pro-family” policy.

In other words, two pillars of the Republican coalition, social conservatives and working-class families, agree that simply allowing parents to keep more of their own money—rather than subsidizing one very specific, work-oriented lifestyle choice strongly preferred by elites—is a much more “pro-family” policy, and one that’s worth fighting for and spending political capital on. But this Republican Senate felt free to ignore their wishes when it came to crafting family policy this spring.

Part of what’s happened is that key pro-family stalwarts—not just Vance and Romney, but also now-Secretary of State Marco Rubio—have either retired or have left the Senate to work in the administration, leaving a smaller group of veteran Republican pro-family senators—like Martha Blackburn (R-TN), Josh Hawley (R-MO), and Mike Lee (R-UT)—to advance pro-family measures. This means we need senators like freshmen Sens. John Curtis (R-UT), Bernie Moreno (R-OH), and Jim Banks (R-IN) to pick up the mantle of pro-family policies and push their colleagues to be more proactive in advancing a family policy agenda that serves the needs of all American families.

Republicans in the U.S. Senate may have another chance to revisit the child tax credit in the coming months and remedy their missed opportunity from earlier this year. They should take that chance, expand the credit, and make it clear that being “the parents’ party” means that parents who stay at home are valued just as much as those who work outside of it.

One former senator weighed in on the value of this approach to family policy: “Poor, working-class and middle-class survey respondents prefer a model with one parent working full-time and the other providing at-home child care,” adding that “the clear majority of Americans say they want to spend more time with their kids. Those preferences aren’t misguided.” He correctly concluded: “Public policy should reflect what most parents want instead of doubling down on the model preferred by American elites.”

That leader? J.D. Vance.

Brad Wilcox is the Distinguished University Professor of Sociology at the University of Virginia, Senior Fellow at the Institute for Family Studies, and the author of Get Married: Why Americans Must Defy the Elites, Forge Strong Families and Save Civilization. Maria Baer is a journalist and co-host of the “Breakpoint This Week” podcast with The Colson Center for Christian Worldview.

Editor's Note: This essay was published first at Deseret News. It is reprinted here with permission.