Highlights

- Young people don’t need to put off their dreams because of pressure to make a display of wealth. Post This

- There’s nothing wrong with choosing family as your priority. Post This

- Just as you can grow accustomed to a high-income lifestyle, you can also acclimate to a lifestyle that accommodates raising a family. Post This

There are a lot of similarities with weddings and raising children. For example, the cost isn't necessarily the main reason couples are turning away from tying the knot or having babies, but when they do finally take these steps forward, they're spending more money on these things, which skews the average cost when estimating expenditures. Our expectations of what are necessary purchases and experiences to afford are biasing the average costs spent of those items into numbers that give us sticker shock.

I have the benefit of having grown up in a small town where backyard weddings are the norm, and if raising children is expensive, you’re doing it wrong. I was raised by a stay-at-home mom with a waste-not attitude and a budget, and this mindset has helped shape the way I approach costs with my own family, especially when moving to larger areas where housing and food are more expensive.

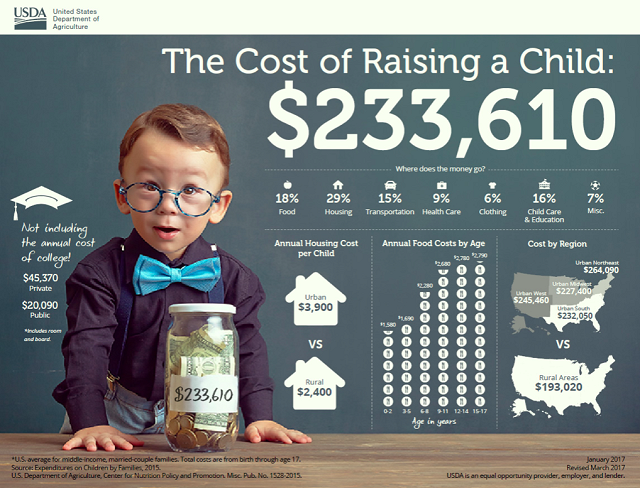

When the above graphic gets shared, it sparks a lot of conversations, with some people saying this is why they have no interest in having children and others demanding more affordable child care. The rare person will do the math to figure out the cost is not that high, while others, like me, are skeptical of any graphic so clearly aimed at convincing people that children are unaffordable. The graphic is overloaded with mostly useless information, avoiding the caveats of the report, forgoing visual representations in favor of numbers. Being a stay-at-home mom, I know that I am not spending anywhere near $4,314 a month to raise my three children! So I wanted to investigate this further, with most of my doubts aimed at the child care and housing estimations.

My husband has been the breadwinner in our household for over a decade now, allowing me to stay home with our children, but it is not without sacrifice. Had I continued working instead of giving up earning potential four years ago, or had I waited longer to have children, it would have been harder to cut expenses and say no to taking on more debt. That's because our perspective would still be that of a dual-income family, accustomed to a higher income lifestyle and not that of a family looking to cut costs. It was an adjustment relearning to price shop and even going down to a single car, but just as you can grow accustomed to a high-income lifestyle, you can also acclimate to a lifestyle that accommodates raising a family. Even our most recent move has made us reevaluate our priorities, because when you are intent on being a family of six with a stay-at-home mom, you can’t expect to maintain the same habits you had in a more affordable area, even if much of everything else has remained the same.

According to the USDA, parents in urban environments are spending 27% more per child than those in rural areas with their greatest cost being housing and food. You’ll find in the same report that higher-income families are also spending more per child seemingly to keep up with their peers and the rising expectations on parents (pressure that we’re putting on ourselves), spending more on schooling and miscellaneous costs than other families. It’s clear that parents are making the cost of raising a child more expensive than necessary, with higher-income families expected to spend, on average, more than twice the amount of families in the lower-income group.

The report’s conclusion is that a middle-income family of four is expected to pay $233,610 per child from birth to age 18. This number jumps to $310,605 when calculated using an adjusted inflation rate for 2022 of 4%, which was higher than the 2.2% rate the USDA assumed we would have when they last updated the report in 2017. These numbers include families from across America, meaning larger urban populations and costs are factored in. It also assumes families are spending 16% of their income on child care and schooling, despite the fact that only about 33% of families outsource their child care to non-relatives, with the USDA report admitting that over half of families reported no expense in that category.

Having a stay-at-home parent or living in a rural area aren’t the only ways to cut expenses, although that number would shrink sizably just with those two changes. Having more or less children will affect this estimated cost, as the cost per child goes up if you only have one (by 27%) and goes down per child (by 24%) once you have 3 or more. As the report explains, that’s because,

Each additional child costs less because children can share a bedroom; a family can buy food in larger, more economical quantities; clothing and toys can be handed down; and older children can often babysit younger ones.

Living in a smaller house and forgoing extra purchases for your teenagers, such as phones and cars that have continued monthly costs, are more examples of cost-cutting options they didn’t factor into the average household, but that doesn’t mean you are required to include them in your personal budget.

When young people say they are worried about having a child or getting married, I urge them to consider that they don’t need to put off their dreams because of pressure to make a display of wealth. The estimated cost of a wedding is $30,000, and most couple’s parents aren’t covering these costs anymore, which is one of the reasons my husband and I chose a courthouse wedding. All we spent money on was our wedding license. The expected cost of raising a child spans anywhere from $202,248 to $430,928, but these, too, are averages with a lot of wiggle room, if you’re willing to cut costs. You don’t have to find yourself on the higher end of these budgets.

There’s nothing wrong with choosing family as your priority. For me and my husband, that meant “giving up” a fairytale wedding in favor of a honeymoon and a downpayment on our house. I “gave up” the idea of living in a large downtown area in favor of moving to a smaller town on the outskirts of the large town where we live, and I “gave up” my career in real estate to be a more effective parent and household manager. These sacrifices have allowed me to volunteer at the school and allowed our family to afford a home in a walkable area with low crime rates. Our household stress levels are lower than when I worked, and we bought everyone bikes when we got rid of the second car. But the best gift these choices have given me is the ability to spend more time with three wonderful children that are hoping as much as their parents to welcome another child into the family next year.

Kendra Holten grew up in a small town where she met her husband and had 3 children before moving to Wisconsin. She enjoys being a stay-at-home mom, writing, and accumulating useful hobbies alongside the useless ones.

Editor's Note: The opinions expressed in this article are those of the author and do not necessarily reflect the official policy or views of the Institute for Family Studies.