Highlights

- The biggest tax change for many families with children this year will be a smaller CTC. Post This

- About 30% of children live in families that won’t receive the full $2,000 per child CTC because their parents don’t earn enough. Post This

- Many low- and moderate-income families should expect lower tax refunds this year as temporarily expanded benefits expire. Post This

Every year, the majority of people who file a tax refund receive a refund, and people like it that way. But for many this year, the IRS is warning that compared with last year, refunds may be smaller. What should families with children expect?

Tax refunds consist of two components: taxes that have been held back from paychecks that end up exceeding what someone owes (often called over withholding) and refundable tax credits (those credits that more than offset taxes owed and can be received as a refund). For families with children, the largest credits are often the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC).

Few people bother to adjust how much tax is withheld from their paycheck each year. And when they do make an adjustment, it’s often in response to a tax bill they’ve received. This inertia is responsible for much of what people receive as a refund at tax time.

Refundable tax credits such as the EITC and CTC can pump up tax refunds. When they file their 2022 tax returns, families with two children can receive a maximum EITC of almost $6,200 and a CTC of up to $4,000 ($2,000 per child up to age 16). In a typical year, a large majority of the EITC exceeds taxes owed, and the same is true for the CTC for families with modest incomes. (The CTC was higher for most on returns filed last year.)

Child Tax Credit Changes

The biggest tax change for many families with children this year will be a smaller CTC. In 2021, tax returns filed in early 2022, the maximum CTC was higher (up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17). The credit was made fully refundable—which means even very low-income families received the maximum credit. For single-parent families, the increased credit amounts began to phase out once income reached $112,500, and for married-couple families, they started to phase out once income reached $150,000.

In 2022, about 30% of children live in families that won’t receive the full $2,000 per child CTC because their parents don’t earn enough. These families will likely receive smaller refunds from their CTC, although the drop will not be as dramatic as losing the full amount, since half the expanded credit was delivered in advanced monthly payments from July to December 2021, not as part of last year’s tax refund.

Interestingly, those monthly payments may actually drive refunds up for high-income families this year. Many high-income families qualified for no higher tax credit last year than this year, but prior to filing their tax return in 2022, they had already received half their CTC. So, unless their withholding adjusted to reflect that change, they can expect larger refunds this year.

Some families with children born in 2021 were not able to claim the CTC until they filed a tax return, so their refunds should decline since they received the full $3,600 credit last year, and they should expect no more than $2,000 this year. Also, 17-year-olds will receive no credit this year as the maximum age of the credit drops back to 16. These families will also likely see refunds decrease.

Child Care Credit Changes

In 2021, some low-income families qualified for the child care credit when it was made temporarily refundable. For one year, families with child care expenses could receive a child care credit in excess of taxes owed. The change was likely modest—the Tax Policy Center estimates that in 2022, less than 1% of families in the lowest fifth of the income distribution will benefit from the child tax credit compared with 5% in 2021.

Combined Effect of CTC and Child Care Credit Changes

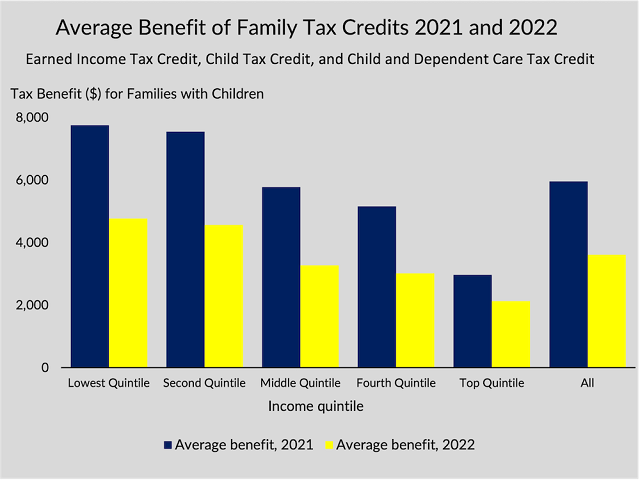

The Tax Policy Center estimates that in 2022, the combined benefit of the EITC, CTC, and Child and Dependent Care Tax Credit was, on average, $4,770 for the lowest income families. That’s about $3,000 less than under 2021 law.

Rebate Checks

Refunds might also be dampened for families who received a rebate payment on their tax return last year. Those rebates ended in 2021, so they won’t show up on this year’s tax return.

Conclusion

Tax refunds can present important opportunities for low-income families to build up emergency savings, catch up on past-due bills, and even encourage college enrollment. They’re often a mystery until they’re received—as will likely be the case this year. But many low- and moderate-income families should expect lower tax refunds this year as temporarily expanded benefits expire. President Biden affirmed his support for the expanded CTC in his State of the Union Address. Now the ball is in Congress’s court—and some predict it will be a tough sell. But perhaps Congress will consider some sort of compromise and invest in children.

Elaine Maag is a principal research associate in the Urban-Brookings Tax Policy Center at the Urban Institute, where she studies income support programs for low-income families and children.