Highlights

- Of the federal and state agencies that run more than 80 federal programs to help low-income individuals and families, perhaps the worst administrator is the IRS. Post This

- One option Congress might consider to eliminate income tax marriage penalties is the flat tax, which treats all taxpayers the same regardless of marital status. Post This

- An important step to eliminate marriage penalties is to take those programs away from the IRS and give them to an agency that knows how to run safety-net programs. Post This

The U.S. individual income tax structure and the safety-net assistance system exact financial penalties on married couples, which worsen when children are in the family. The effect of these penalties is the opposite of what public policy should be. Research has established that society benefits immensely from stable and healthy marriages. This article focuses on U.S. Tax Code and restoring the income tax to its primary purpose while eliminating marriage penalties (it is excerpted from section 1 of a two-part policy brief on how to eliminate marriage penalties from the tax code and safety-net programs).

Remove Safety-Net Programs from the U.S. Tax Code

Of the federal and state agencies that run more than 80 federal programs intended to help low-income individuals and families, perhaps the worst administrator is the Internal Revenue Service (IRS) that runs several safety-net programs, including the Earned Income Tax Credit (EITC) that provided $64 billion in cash assistance to 23 million tax filers in 2024.

While many policymakers view the income tax system as an efficient way to dispense safety-net benefits, IRS performance leaves much to be desired. A recent Wall Street Journal article listed the EITC with the second-highest improper payment rate—more than five times the average improper payment rate. The Journal’s article did not reveal anything new. The IRS also runs the program with the highest improper payment rate, the American Opportunity Tax Credit.

When it comes to marriage penalties, the income tax structure is a bad fit for distributing money to needy households. While there are tax filing statuses for married couples, heads of household, and single individuals, there is no option for unmarried couples. Consider an unmarried couple with two children. One partner can claim both children as head of household while the other files as a single person. Or they can split the children as heads of household. Either way, they will be treated differently than if they were married.

Congress could create a new tax filing status to accommodate unmarried couples. However, it may be more trouble than it is worth. Unmarried couples run the gamut in financial and relational commitments, and using tax law to address the various situations is complicated and may be perceived as too intrusive for those who just want to pay their tax liability.

Besides, the IRS is set up for annual returns and refunds, not monthly payments. EITC recipients must wait until the following tax year for their benefits. Monthly payments would give assistance when needed, allow families to properly budget, and would be a more effective way to encourage employment, one of the goals of the program.

The EITC had an advance payment feature that was repealed in 2010 due to poor participation and administrative problems. The system relied on employers making the monthly payments to their employees and then being reimbursed by the IRS, but the Government Accountability Office found IRS procedures to be ineffective with noncompliance rates of 80 percent. Although repealing the advance payment feature eliminated this extreme noncompliance rate, the IRS continues to struggle with taxpayer noncompliance with the EITC program.

Removing safety-net programs from the tax system would allow Congress to focus on making the income tax marital status neutral. In 2017, Congress was successful in eliminating marriage penalties for single individuals who want to marry, provided they have no children and do not qualify for refundable tax credits.

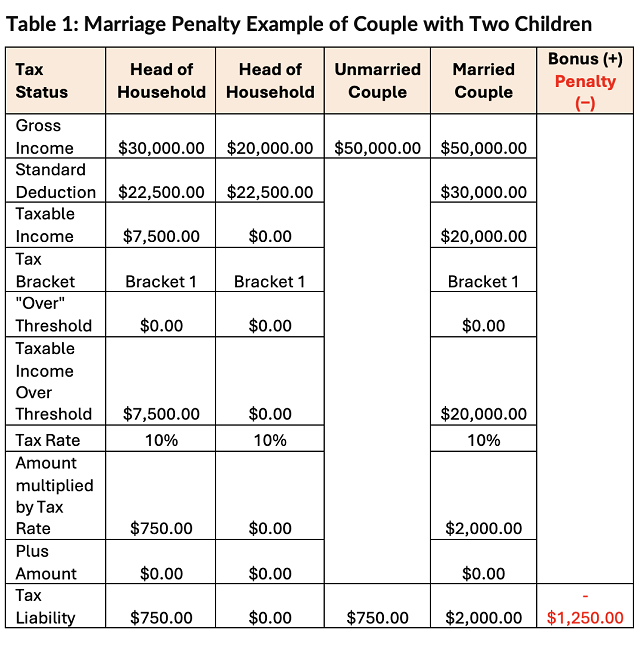

However, marriage penalties remain for the rest of tax filers. For example, suppose a mom earns $20,000, a dad earns $30,000, and they have two children. Table 1 shows the simple tax liability before tax credits for tax year 2025 assuming that, as an unmarried couple, each parent claims one child and the standard deduction. The tax liability before tax credits is $750 if they live together unmarried but $2,000 if they are married, which means a marriage penalty of $1,250. Even if one parent claims both children, there would still be a penalty.

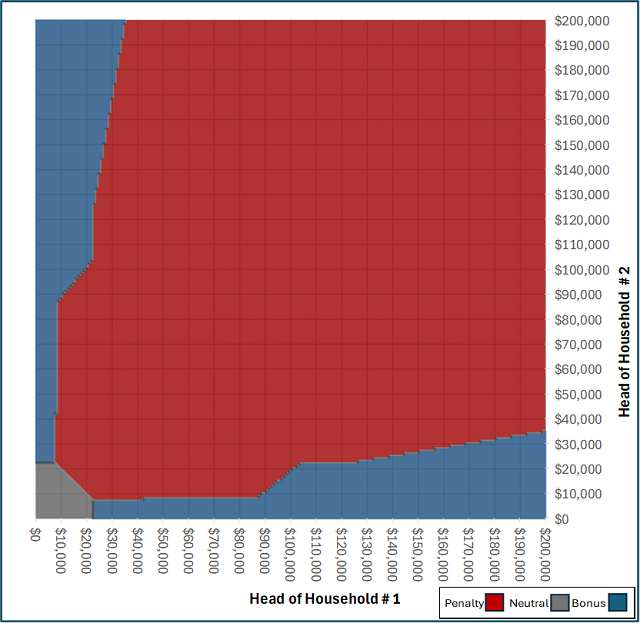

The example in Table 1 is just one wage combination for a couple with two children. The Georgia Center for Opportunity ran 40,401 wage combinations for this couple if each partner claims one child on their taxes and found that 81% had a marriage penalty. The figure below shows the distribution of the penalties (in red), neutral outcomes (in gray), and the bonuses (in blue).

Figure 1: Marriage Penalties for Couple with Two Children

for Tax Year 2025

One option Congress might consider to eliminate income tax marriage penalties is the flat tax, which treats all taxpayers the same regardless of marital status. The reason can be easily shown using mathematics because the flat tax follows the distributive law of multiplication (see full policy brief for more).

Conclusion

The U.S. Tax Code is ill-suited for running safety-net programs without marriage penalties. Furthermore, the IRS has an awful record of improper payments and noncompliance when it comes to running its safety-net programs. Therefore, an important step to eliminate marriage penalties is to take those programs away from the IRS and give them to an agency that knows how to run safety-net programs.

Download the full policy brief for an explanation of how these other agencies can eliminate all marriage penalties in safety-net programs.

Erik Randolph is Director of Research for the Georgia Center for Opportunity. In prior roles, he served as Special Assistant to Pennsylvania Secretary of Public Welfare, analyst for the Pennsylvania House Appropriations Committee, and economic development analyst for the Pennsylvania Department of Commerce.