Highlights

- The AFA dramatically ramps up financial support for low-income families relative to the existing child tax credit. Post This

- The AFA would have a huge impact on child poverty, and it could also boost fertility, adding tens or hundreds of thousands of births each year. Post This

- While it has some flaws, the common arguments against the AFA, like cost, work discouragement, welfare dependency, or effects on marriage, don’t really hold up. Post This

A majority of Democrats in the U.S. House and Senate have signed on to support a new piece of legislation called the “American Family Act.” As Dylan Matthews explains at Vox, it is nearly certain to be passed the next time Democrats have a majority in both chambers. If President Trump is still President after 2020 and vetoes it, they’d have to wait until their next presidency, but some version of it is a near-certainty, eventually.

The proposal greatly expands the Child Tax Credit (CTC), making it worth up to $3,600 per child for families with young kids. But the changes are so dramatic, it’s almost better to think of the plan, not as expanding the CTC, but rather as implementing a new child allowance. For example, the bill calls for the benefit to be paid out in monthly checks, rather than as part of a tax refund.

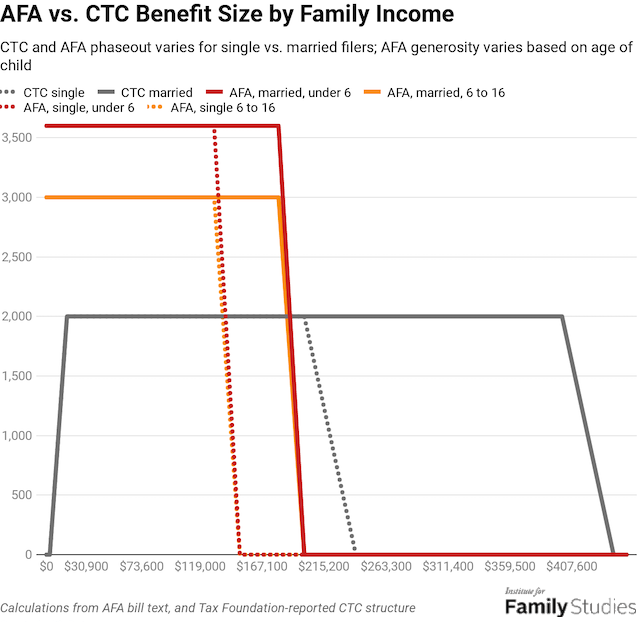

Rather than explain the math of the American Family Act’s (AFA) changes to the CTC, I’ll just show you in the figure below.

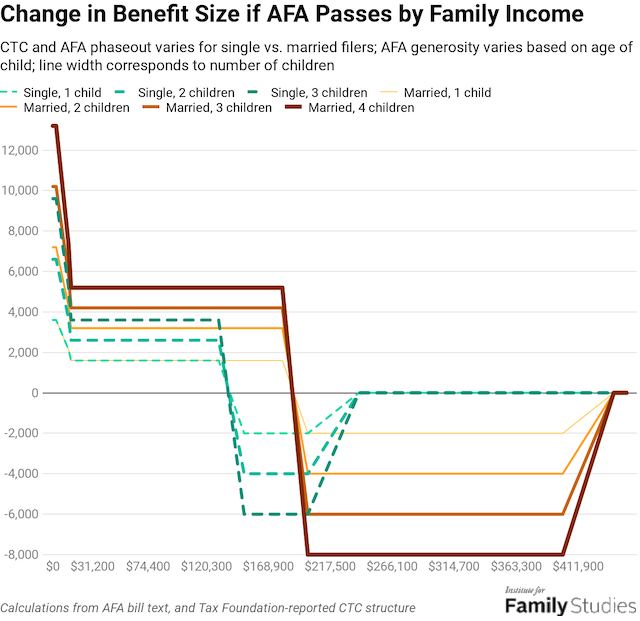

We can also represent this a bit more simply, by showing the change in benefit levels across incomes for some example families, based on different marital statuses and number of kids.

As the figure clearly shows, the AFA dramatically ramps up financial support for low-income families relative to the existing child tax credit. This is because the existing credit has strict limits on its refundability that prevent many low-income households from getting the benefit. The AFA removes that restriction, and so would dramatically boost the incomes of poor families.

But beyond that, the AFA would be a net positive for virtually all single parents making under $150,000, and all married parents making under $200,000. That’s the overwhelming majority of parents. High income families, especially those with multiple children, would stand to lose as much as 4 or 5% of their income, thanks to the AFA having a lower phase-out range than the current CTC. But before the recent tax reform, the CTC phase-out range was a lot lower than it is now: the benefit being removed didn’t exist before a year ago.

With a major child allowance now on the table, and with a real shot of being implemented in the next few years, it’s time for conservatives to take stock of the evidence on the issue and decide if we are really willing to support families.

Various writers here at IFS have written about child allowances many times. I’ve written about their modest effects on birth rates and highlighted the case of Hungary. Joshua McCabe has written about Canada’s encouraging success in implementing such a benefit and explicitly called for something similar here. Samuel Hammond has written about why universal child care is bad, with a major reason being that a child allowance would be better. Reviewing proposals from a left-wing think tank, Patrick Brown raised some concerns about the cost but broadly treated it as an improvement on the status quo. IFS founding editor Anna Sutherland proposed a “home care allowance,” which is a short step away from a child allowance. Robert Verbruggen has probably been the IFS writer most skeptical of child allowances, but even his critiques have been fairly moderate.

In other words, in virtually every case where IFS has published a piece about a child allowance, those posts have been cautiously favorable to the idea. There are issues to be resolved, but in principle, I think most writers on this blog would agree it’s a reasonable plan. With the AFA now getting a lot of attention and, if Democrats make gains in 2020, with it being likely to pass, it’s time to consider whether the AFA could be a satisfactory proposal.

The Problems: Child Poverty, Unstable Families, and Low Birth Rates

AFA backers claim to be trying to solve one problem: child poverty. But conservatives may have an additional and different objective. When I previously reviewed various child benefits, my interest was in estimating their likely effects on birth rates. There is a broad consensus that big shocks to child benefits do alter birth rates in the short run, and even modestly in the long run.

Some of the most compelling evidence comes from Australia, where numerous studies of their “baby bonus” program found both short- and long-term increases in births and birth intentions. Estimates of effect sizes vary, with the most optimistic suggesting that one extra baby was born for every $30,000 spent, to the most pessimistic, suggesting it cost more like $300,000 for every extra baby. The central estimate in most studies and specifications seems to be around $100,000-$150,000 per extra baby.

Using this range, but dramatically reducing the estimated effect size since child allowances have much weaker effects than lump-sums like Australia's, we might expect the AFA to increase births by between 70,000 and 500,000 births per year. Instead of having a national total fertility rate of about 1.73 in 2018, yielding 3.8 million births, with the AFA, we would have 3.9 to 4.3 million births, and a fertility rate of between 1.78 and 1.97 children per woman. That’s a huge difference. Notably, after implementing the baby bonus, Australia’s fertility rate rose from 1.73 to 1.96 kids per woman.

Thus, the AFA would have a huge impact on child poverty, reducing it by more than a third, perhaps as much as half, and it could also boost fertility, adding tens or hundreds of thousands of births each year. By increasing fertility by perhaps as much as 0.25 births per woman, and using sensitivity analyses conducted by the Social Security trustees, it turns out that AFA could even help make Social Security more solvent: an additional 0.1 kids per woman is associated with about a 7% improvement in Social Security’s long-run actuarial balance.

Beyond these benefits, by reducing financial strain on families and creating an explicit benefit for childbearing, the AFA would support stronger families across a wide range of incomes. It’s not unreasonable to suppose that it could reduce the prevalence of divorces motivated by financial strains, as well as yielding other positive family outcomes. Australia’s baby bonus, for example, has been shown to improve child health and even eventual test scores.

However, like all new government programs, conservatives may have some concerns about the AFA.

The Cost of Family Life

It costs a lot of money to give a family allowance to every child. The AFA's cost estimate runs at about $90 billion above current spending levels. Without raising new revenue somewhere else, it will make a big hole in the national budget. Neither party has much practical concern for fiscal responsibility, as demonstrated by equal-opportunity budget-busting under Obama and Trump, but while politicians may not care about what debts they pass on to their kids, family-policy analysts probably should.

While conservatives may balk at a $90 billion expense of the AFA, it’s easy to find ways to pay for it that conservatives can endorse.

That $90 billion could be paid for in a variety of ways. My preference is to pay for it without touching anybody’s income tax returns, without creating any new taxes, and without removing other benefits for families. Democrats may prefer to raise income taxes, and some other conservatives may prefer to pay for a new family benefit by slashing old ones, but both of those seem like bad options to me. I think we should actually make family life better and easier for families: taking money out of one pocket to put it into the other doesn’t accomplish that. Like my other colleagues at IFS, I agree that consolidating programs for kids into one child allowance is a good idea. But the relevant political question is whether or not we should increase the total level of support for children.

Even with these funding guidelines, however, it’s easy to find ways to pay for a child allowance. For example, the federal government raises about $90 billion per year in taxes on alcohol, cigarettes, guns, gasoline, and other excisable products. Most of these products are either luxury goods or have a tendency to hurt and kill people or damage the environment.

And while many conservatives may be upset about bullets costing 9% more than they currently do, that’s a small price to pay for cutting child poverty in half, making Social Security more solvent, strengthening middle-class family life, and pushing the birth rate back towards something that can actually sustain a civilization without needing mass migration to prop it up.

The child allowance in question will be more than big enough to offset the higher price of alcohol and gas. Even if you’re like my family growing up, and you consume something like 3,000 rounds of ammunition per year, the annual cost of higher ammo taxes would be under $100. The average American would face about $300 in higher consumption taxes through these products: meaning that even in a family of 5, the child benefit from one kid would more than offset the total increased tax bill for the family. On net, it is almost impossible to come up with a mathematical scenario where a family with kids and under $200,000 in income would lose money paying for a child benefit by doubling every excise tax.

That’s just one proposal. There are other options. We could raise taxes on companies that offshore jobs. We could just switch the mathematical formula we use for inflation-adjusting Social Security benefits to a slightly less rapid increase. And of course, there’s no shortage of non-family-related government programs we could cut to free up all or some portion of the needed $90 billion. My point is not to outline a specific pay-for, but just to note that while conservatives may balk at a $90 billion expense, it’s easy to find ways to pay for it that conservatives can endorse. Charging urban progressives a few cents more for their $18 cocktails to pay for parents to buy diapers is worth it.

Would the AFA Discourage Work?

There’s an argument that providing a child benefit will reduce work effort by parents. There’s some truth to this. What economists call the “income effect” means that providing people unrestricted cash probably reduces how many of them work. Academic research suggests that child allowances do somewhat reduce work effort, particularly among married women. Across a range of studies, the evidence suggests that married women’s labor supply is about 35% more responsive to a child allowance than single moms: and that’s not accounting for the fact that many married women are not moms. Among just married moms, the effect is probably much larger. That said, the evidence is mixed: in Canada, implementing a child allowance led to more women working.

And since the vast majority of the work-discouraging effect observed in the academic literature on child allowances is among married moms, and because married moms outnumber single moms, it's important to understand that most of the people whose work is currently being induced by a lack of child allowances are married moms, and the work of many is probably just barely covering the cost of daycare. This means that the dominant effect of a child allowance won’t be single moms quitting their jobs to live off the allowance, but rather married moms staying home with their kids.

But, aside from the empirical facts suggesting that a child allowance mostly empowers traditional family life rather than encouraging single motherhood, this is all a really strange argument. Is it really conservative to say that both parents should always have to work? Since when were conservatives opposed to stay-at-home parents? Are we suddenly supposed to believe that conservatives want to see every adult in the workforce and every child raised in a daycare center? Of course not.

Is the AFA Really Welfare?

Still, many people don’t like the idea of taking handouts or welfare. Surveys of voters show many reject the idea of cash handouts from the government. Because the child allowance does not phase out until a fairly high income, it doesn’t create “welfare cliffs,” where making more money can cause a person to lose benefits and actually be worse off—something that hurts many low-income people. In fact, because the child allowance envisioned by the AFA is close to universal, it’s not proper to call it welfare at all. It’s no more welfare than the standard deduction, or Social Security, or tax-exempt Roth IRAs. The government has many programs that reward people for doing things that benefit society, like saving and investing. Having and raising children is useful for society, too. It makes sense to reward it more than we presently do. With the understanding that it’s basically a universal benefit recognizing the work that parents do, not a handout, the benefit is unlikely to have any stigma attached to it.

A simple, flat child allowance with a high phase-out will have only very modest work-discouraging effects, and mostly among married moms who want to raise their kids at home. It won’t eat away at anybody’s dignity for society to say “thank you” to parents for their hard work in the form of a check.

I wholeheartedly agree with conservative critiques of welfare. The early phase-outs of SNAP, TANF, and other welfare benefits have huge work-discouraging effects, and welfare dependency corrodes peoples’ sense of dignity. And if a child allowance had a phase-out threshold that hit middle-class families and discouraged their work, and if it were structured like welfare and likely to create a dependent class, it’d be worth opposing. But a simple, flat child allowance with a high phase-out will have only very modest work-discouraging effects, and mostly among married moms who want to raise their kids at home. It won’t eat away at anybody’s dignity for society to say “thank you” to parents for their hard work in the form of a check. I’m fine with giving mom a wage for her work, and I think, when presented with the argument, most other conservatives are, too.

Broken Families, Unwed Mothers

“Sure,” a smart, well-intentioned conservative critic might say to the above points, but:

“Won’t a child allowance basically be a subsidy for unwed childbearing? And doesn’t growing up without two parents have bad effects for kids? So couldn’t we be fixing child poverty, but still hurting kids in the process?”

It’s a fair concern. And it is true that kids benefit from having two parents. If a child allowance created a boom in unwed parenting, that would be concerning.

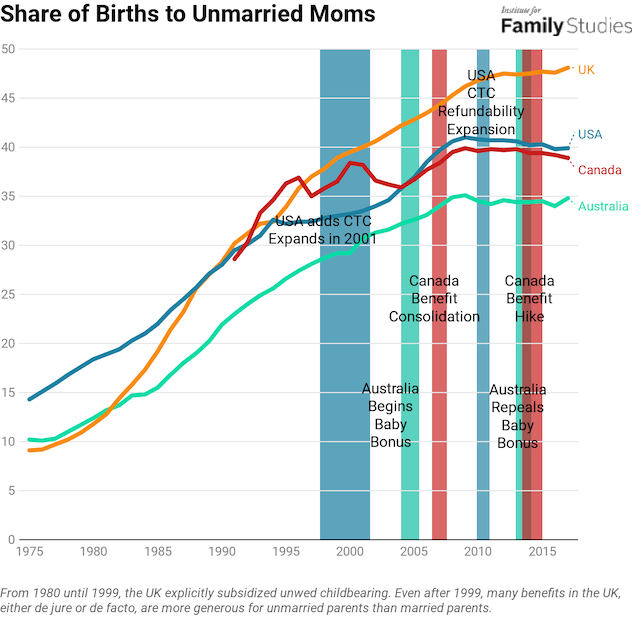

Luckily, we can look to the examples of similar countries that have implemented big increases in cash benefits for families. Australia implemented a “baby bonus” in 2004, Canada consolidated programs and increased spending on kids in 2006 and again in 2014, and the US expanded the child tax credit in 1999-2001 and around 2010. So what happened?

As the figure illustrates, there is simply no association between implementing pro-natal benefits, like a child allowance, and changes in the marital composition of births. Testing the level of and yearly change of cash benefits to families in OECD countries also turns up no association with unwed parenting. The United States has the least child benefits of these countries, yet the lowest births-in-marriage share. When Australia implemented a baby bonus, the decline in married births continued, then changed in the late 2000s, uncorrelated with their benefit. Canada’s trend has been virtually identical to America’s.

Notably, the United Kingdom’s experience has been a bit different. The UK greatly expanded child benefits between the early 1990s and the 2010s, with a range of benefits and tax provisions. Meanwhile, unmarried childbearing skyrocketed, and didn’t start to level off until the government froze benefits. But there’s a trick to this: until 1999, the British government explicitly gave higher benefits to unmarried moms, and they continue to give bigger benefits to firstborn children, who are more often to unmarried moms. Many UK child-related provisions have explicit favoritism for unmarried parents. In other words, the reason benefit expansions in the UK have been associated with more unmarried childbearing isn’t the size of the benefit, but the structure.

Neither the current CTC nor the proposed expansion has any appreciable marriage penalty, unlike the EITC, which hugely penalizes married people. There is no evidence that similar benefits in similar countries have boosted unmarried childbearing more than married childbearing. The evidence that does exist suggests that pronatal effects mostly show up among married women, and women who may have higher-parity births: third and fourth births are a lot more sensitive than first births. Combining this all together, we can see very quickly that the main effect of a child allowance isn’t to encourage unwed births; it’s to, on the margin, favor slightly larger families among married people.

Still, the AFA Needs Improvement

While in principle a child allowance is a good idea, and in practice, the AFA is a respectable effort in that direction, there are some significant areas of concern. For example, the recent tax reform added a requirement that to claim a tax credit, the tax filer had to list the Social Security Number of each child. This measure was intended to cut down on fraud, especially among illegal immigrants. The AFA appears to get rid of this requirement. That’s a mistake, and it should be fixed. There is absolutely no reason that American taxpayers should pay a child allowance to, say, an illegal immigrant. Plus, reducing unjustified allowance payments will reduce the cost of the program.

And while it’s easy to find ways to pay for the AFA, in practice, its proponents do not seem interested in paying for it. But this is another place where Republican legislators who sincerely want to improve life for American families could engage constructively: they could offer to support the AFA if it is at least 75% paid for without raising any income tax rates or cutting defense spending, for example.

Finally, the AFA has a few structural problems. For example, the benefits phase out at an extremely rapid pace: an 18% phase-out for high-earners with kids under age six, and 15% for those with kids under age 17. Some sources have reported that the phase-out rate is just 5%, but the bill's text and explanatory fact sheet lay out clear math showing a phase-out rate of between 15% and 18%. Specifically, the bill says that the amount of the credit shall be reduced by the quotient of the base credit ($3600 for kids under 6, $3000 for kids 6 to 16) divided by $20 times the number of children. So in a household with one 3-year-old child, the phase-out would be $3,600 divided by $20: so $180 per $1,000. The rate is $150 per $1,000 for older kids. For households with some older and some younger kids, the exact phase-out pace varies between $150 and $180.

By not making the child allowance fully universal, the AFA creates distortionary work incentives, marriage penalties, and it excludes high-earners, who tend to be politically influential.

A smoother, less aggressive phase-out would probably cause fewer economic distortions. Furthermore, it is concerning that the AFA creates a marriage penalty: the threshold doesn’t double for married people. It’s a bit absurd to give a benefit to families, then punish employed parents for getting married. While this marriage penalty only impacts some higher-earners, the broader issue here is that it exists at all. By not making the child allowance fully universal, the AFA creates distortionary work incentives, marriage penalties, and it excludes high-earners, who tend to be politically influential. Adding the children of high-earning households doesn’t add that much to the cost, and can solve all these problems.

Finally, the payment method is unnecessarily complicated. In a “normal” child allowance, parents get a check each month for each kid. This helps communicate that society values those kids and supports the parents and directly raises incomes. And that’s what the AFA sounds like it does, on its face: monthly checks for kids. But the details are messy. It turns out, families with tax liabilities that can be offset by the AFA (that is, families with good jobs) would not get monthly checks: they would claim the whole credit on their normal tax refund. Only families who can expect a negative income tax as a result of the AFA would get monthly checks. And because it’s possible peoples’ incomes could be misstated, some families might even have to pay some of the credit back.

Luckily, this problem can be solved in the exact same way as the marriage penalty and work disincentives. Just make the credit truly universal. Make it fully refundable for everyone. Call it a tax credit, but treat it like spending, and then tax people like normal. That way, everybody gets the same, simple monthly child allowance checks.

Conclusion

The AFA as it stands today has serious flaws: it does nothing to consolidate existing complicated benefits, it creates new work and marriage disincentives for some families, it delivers benefits in an absurdly complicated way, and it recreates administrative loopholes that Congress literally just fixed. Luckily for the AFA’s sponsors, these problems can all be fixed by fairly straightforward amendments to the bill’s text, and fixing them would not radically alter the bill’s costs, effects, or benefits.

Meanwhile, the common arguments against the AFA and other child allowances, like cost, work discouragement, welfare dependency, or effects on marriage, don’t really hold up. The American Family Act would dramatically reduce child poverty while increasing the number of children born. Those kids would be born into families of all types, but those born into married families would be more likely to benefit from having at least one parent stay home with them in their early years. That’s a world I think most conservatives would like to see.

Lyman Stone is a Research Fellow at the Institute for Family Studies, and an Adjunct Fellow at the American Enterprise Institute.