Highlights

- “I believe in the institution of marriage,” Carlotta said, "[but] I can’t lose my coverage.” Post This

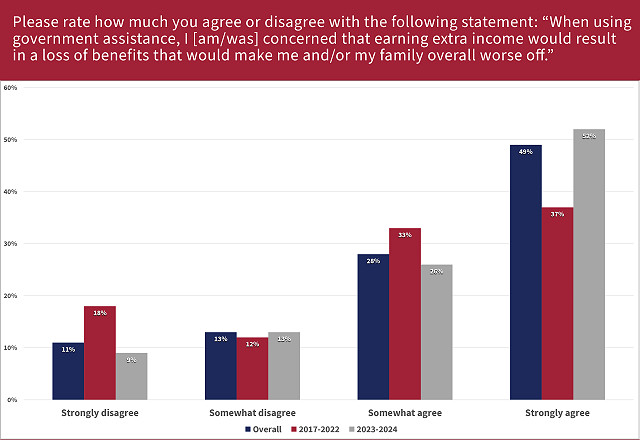

- 77% of Utah respondents said they were worried that an increase in household income would trigger a loss of benefits that would make their family worse off. Post This

- Congress should support, and states should pursue, waivers to experiment with smoother transitions for safety net participants who get married or increase their earned income. Post This

Carlotta is a resident of the state of Georgia who is trying to navigate the government social safety net while pursuing opportunities to strengthen her financial stability. During a focus group conversation in 2024, Carlotta shared that she had decided to forgo marrying her longtime partner out of fear of triggering a sudden loss of government benefits that would have made her worse off—commonly called a “benefits cliff.”

“I believe in the institution of marriage,” she said. “I have very traditional beliefs and values, and that’s something that’s very important to me... [but] I can’t lose my coverage.”

Carlotta explained that if she got married, she would lose government medical coverage that she relied on, and their household’s earned income wouldn’t be enough to make up the difference. “That would just be foolish—it would be like shooting myself in the foot or something like that, getting married,” Carlotta added.

She shared her story with me during a series of informal conversations Sutherland Institute held in partnership with the Georgia Center for Opportunity for a recent Sutherland paper, Strengthening the American Dream: Addressing benefits cliffs to empower safety net participants to pursue work and opportunity. As part of this analysis, Sutherland partnered with Lighthouse Research to survey 480 Utah adults who were current or recent participants of the programs that traditionally constitute the safety net (including Medicaid, the Supplemental Nutrition Assistance Program, child care assistance, and other federally funded, state-administered assistance programs).

This new research helps answer crucial questions that policy professionals grapple with, such as:

- Does the structure of our safety net system create unintended consequences in the form of disincentives to the pursuit of opportunities like work and marriage?

- Do safety net participants actually respond to these incentive structures by limiting their own economic or familial progression?

- Are there particular programs that most often stand out in participants’ minds as they seek to prevent benefits cliffs or plateaus?

Our findings show that in various ways, the answer to each of those questions is yes.

Even in pro-family Utah, some participants in the social safety net have had an experience similar to Carlotta’s—changing their behavior and forgoing marriage due to what they perceive as disincentives built into the system. An even greater share of respondents indicated they had limited their economic progression in other ways. When asked to respond to generalized concerns about benefits cliffs or plateaus, 77% of Utah respondents said they were worried that an increase in household income would trigger a loss of benefits that would make their family worse off.

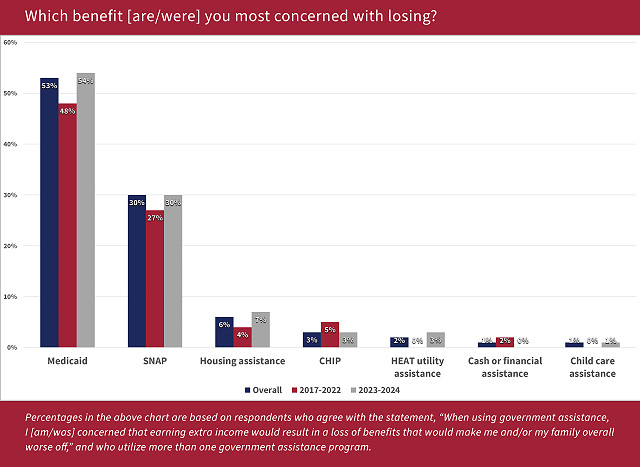

Overall, respondents most often said that Medicaid (53%) and SNAP (30%) were the programs they were most concerned about losing.

While much of the survey focused on what we call “intentional earnings reductions” related to work opportunities, it’s important to recognize that marriage represents a life step that can also increase earning potential and create additional financial stability for a family. As such, a thorough analysis of which kinds of intentional earnings reductions that safety net participants may engage in should include marriage.

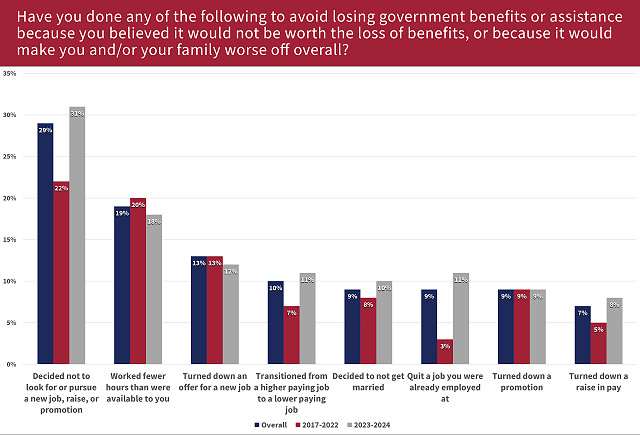

To understand how these general concerns influence actual behavior, we asked respondents if they had ever engaged in a range of various intentional earnings reductions. We found that 43% had taken at least one of the actions listed. Notably, 9% said that at some point they had decided not to get married.

Forgoing marriage is less common among safety net participants than other intentional earnings reduction—such as deciding to stop pursuing opportunities or working fewer hours. However, the fact that even 1 in 10 have decided to refrain from participating in this major civic institution due to a perceived government disincentive is alarming.

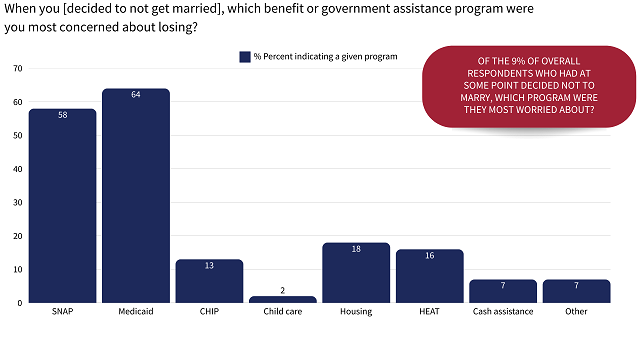

Our survey findings also draw a direct connection between specific intentional earnings reductions and the particular program respondents are most concerned about losing. In the case of those who declined marriage, SNAP and Medicaid were the programs that respondents most often identified.

Of the 9% of respondents who had at some point decided not to get married, 58% identified SNAP and 64% identified Medicaid as the programs they were most concerned about.

Taken together, these findings should prompt policymakers at the state and federal level to take a serious look at how to better help families in the safety net feel empowered to achieve key milestones like marriage and growth in their vocation. After all, a safety net system in which large portions of participants feel disincentivized from such opportunities is in dire need of reform.

Consider that 58% of respondents who had at some point turned down marriage cited SNAP as their primary concern. At a recent Sutherland/Weber State event, a Utah Department of Workforce Services representative clarified that SNAP eligibility rules do not take marital status into account when determining benefit amounts. Instead, if a couple with one or more children lives together and eats together—thus forming a “household,” irrespective of marital status—their combined income would count toward their benefit allotment.

Any policy intervention to address benefits cliffs, plateaus, or other disincentives needs to first seek to identify where there are perception gaps vs. structural gaps in the social safety net.

A good first step for those at the state level wishing to address disincentives in the safety net is to implement a pilot program that helps participants better navigate the different eligibility rules of these programs as their earned income increases. As outlined in Sutherland’s Strengthening the American Dream report, this kind of intervention should focus on three key principles:

- Families should have more certainty about their financial future through financial planning tools or resources that show proactively how higher income (whether from work or marriage) affects their benefits.

- Families should also benefit from enhanced community coaching or mentoring to leverage the strengths of the social capital of the local nonprofit community.

- Key metrics and outcomes should be carefully tracked throughout the intervention to capture what is most helpful to these families and where structural reforms should be pursued.

On the federal level, policymakers should give states additional flexibility to innovate and experiment with different approaches to helping our fellow Americans successfully transition off government assistance and into work-based self-reliance. Crucial to this flexibility is the use of federal waivers for state-level experimentation. Wherever true structural barriers that create a material disincentive arise in the social safety net, state leaders should pursue waiver authority to establish pilot programs that phase out benefits in such a way that participants feel incentivized to pursue life milestones like marriage and work advancement.

In particular, targeting these innovative pilot programs to programs with large numbers of participants, where research shows there is also a disincentive effect, would make a significant impact. As the Sutherland data shows, SNAP and Medicaid are prime candidates.

Carlotta’s experience shows us that if marriage triggers a significant reduction in health coverage benefits, some may forgo it entirely. Congress should support, and states should pursue, waivers to experiment with smoother transitions for safety net participants who get married or increase their earned income in order to eliminate disincentives to work, marriage, and upward mobility for their families.

Nic Dunn is vice president of strategy and senior fellow for Sutherland Institute, where he also hosts the podcast Defending Ideas.