Highlights

Millennials are taking longer than previous generations to reach two traditional milestones of adulthood: marriage and parenthood. Not only are young adults delaying marriage longer, but they are more likely to cohabit and have children outside of marriage, often in cohabiting unions. And as Pew reported a few years ago, Millennials are less likely than older generations to connect marriage to parenthood, particularly when it comes to child well-being.

But how does the order of marriage and parenthood in Millennials’ lives—or whether young adults marry before having children or have children before marriage—affect their future financial success? A new report released today by the Institute for Family Studies (IFS) and the American Enterprise Institute (AEI) tackles that question and finds that Millennials who pursue a sequence of steps that include putting marriage before parenthood are more likely to be on track to achieving the American Dream.

The report, The Millennial Success Sequence: Marriage, Kids, and the “Success Sequence” among Young Adults, was authored by IFS research director Wendy Wang and IFS senior fellow W. Bradford Wilcox. They analyzed Bureau of Labor Statistics panel data on young adults born between 1980 and 1984. They found that Millennials who follow the “Success Sequence” (earn at least a high school degree, get a job, and marry before having children—in that order) are significantly more likely to avoid poverty and be on a path to financial success than those who do not. In fact, the overwhelming majority (97%) of Millennials who follow the “success sequence” are not poor by the time they reach ages 28-34.

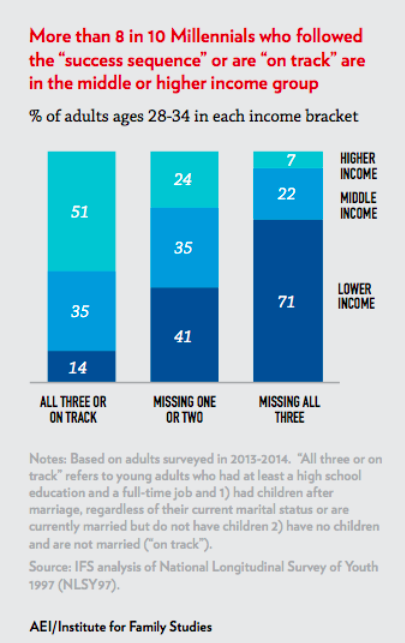

As the figure below indicates, 86% of Millennials who either followed all three steps, or are “on track” to do so, are in the middle or top income groups in their prime adult years (ages 28-34). However, only 29% of young adults who missed all three steps are in the middle or higher-income groups. (In the study, “on track” is defined as “those who have no children and are unmarried by ages 28-34, but have followed the education and work steps.”)

That education and hard work are linked to better financial outcomes in adulthood is perhaps a no-brainer for most of us, but in a society with increasing cohabitation and unmarried parenthood, the link between marriage and financial well-being is not quite as clear. It’s a particularly hard sell for young adults, who, as noted earlier, are more likely to cohabit and have children before or outside of marriage.

Indeed, the report finds that 55% of Millennial parents had their first child outside of marriage—more than double the share of Baby Boomers when they were young adults. Although 25% of these Millennial parents married after the baby was born, 30% did not.

But getting married before having children is as essential to young adults’ future financial success as following the education and work steps, according to Wilcox and Wang, who note: “Millennials’ economic fortunes differ depending on which comes first in their lives: marriage or parenthood.”

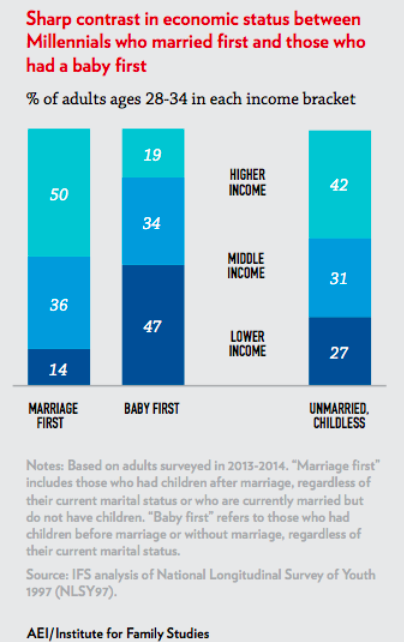

They found that Millennials who marry before having children are twice as likely to be in the middle or upper-income groups as those who have children outside of marriage, even after controlling for factors like race/ethnicity, education, and family income growing up.

The figure below shows that 36% of "marriage-first" Millennials are in the middle-income bracket when they reach adulthood, and 50% are in the top third. But almost half of young adults who had a baby before or outside of marriage are in the bottom third of the income distribution.

The strong link between economic success and married parenthood holds for Millennials from all racial/ethnic and family income backgrounds—especially non-white adults. As the report explains:

Among black young adults, those who married before having children are almost twice as likely as those who had a baby first to be in the middle or upper-income groups (76% vs. 39%). In contrast, white Millennials who followed the ‘marriage first’ sequence are about 1.5 times more likely to achieve financial success as their counterparts who had a baby first (87% vs. 60%).

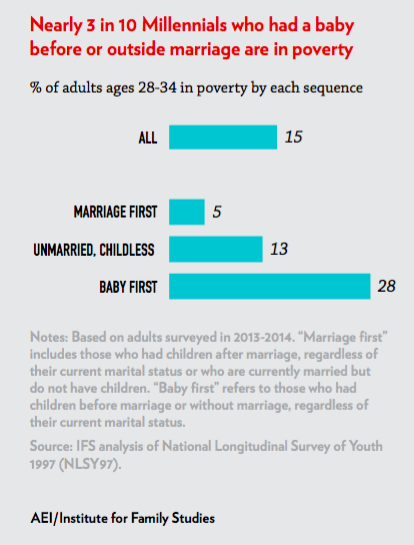

Having a baby within marriage is also a key to avoiding poverty (see figure below). In fact, the report notes that getting married before having a first child reduces the odds that young adults will be in poverty by a striking 60% (compared to having a baby first).

So, what is it about marriage that helps boost the odds of financial success for young adults? According to Wilcox and Wang, “Stable marriage seems to foster economies of scale, income pooling, and greater work effort from men, and to protect adults from the costs of multiple partner fertility and family instability.”

They conclude the report with several policy recommendations aimed at making the “three pillars of the American Dream” (education, work, and marriage) more “attractive” and accessible to young people, especially those from lower-income families. Importantly, this includes the development of public and private social marketing campaigns promoting marriage and the "success sequence" to youth.

Such a campaign seems to be particularly timely, considering Millennials' desire for more direction on how to form healthy relationships. As we reported last week, a recent Harvard survey found that 70% of young adults wish they had received more information and guidance about finding lasting love from their parents (presumably this would include marriage). A strong and consistent message on how following the “success sequence,” including delaying parenthood until marriage, is linked to their economic well-being just might be a message that young adults are ready to hear. And given the myriad of benefits of married parenthood for adults, children, and society that extend beyond financial success—including success in school and greater family stability—it is certainly a message Millennials and younger generations need to hear.